To promote transparency of this process, the Office of Management and Budget could publicly report the actual reductions in budget authority each year as a result of sequestration.

Under current law, sequestration of mandatory spending will continue through 2030. Since 2013, sequestration of mandatory spending has occurred each year, resulting in smaller and delayed direct payments to program beneficiaries, reduced services, and reduced tax credits, among other things.

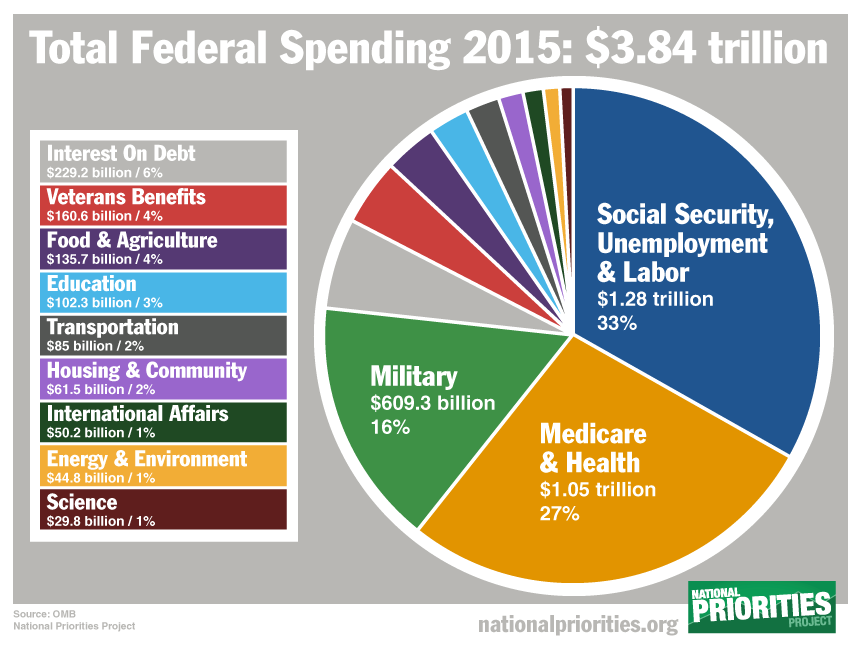

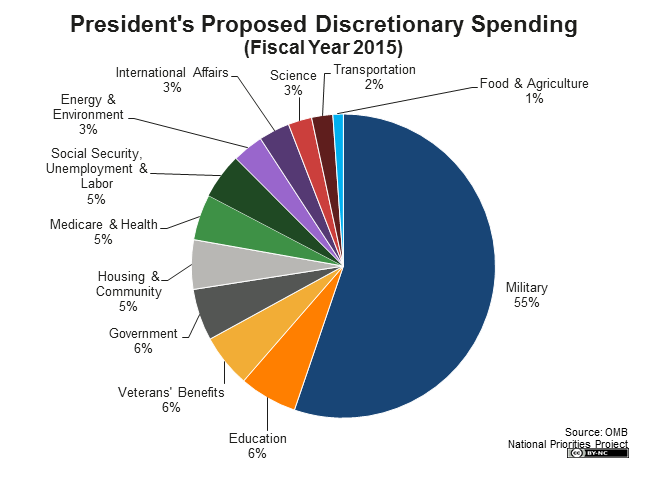

Operating under CRs has sometimes resulted in inefficiencies-such as delays in hiring and increased work from issuing multiple repetitive grants and contracts for the duration of each CR. For instance, Congress has enacted continuing resolutions (CRs) in all but 3 of the last 46 years (as of FY 2022) to allow agencies to continue operations until final appropriations decisions are made. However, agencies also face disruptions and ongoing uncertainty in the federal appropriations process. Agencies have managed their funds in various ways to do so, such as carrying over funds from the prior year for use in the current year, and using intragovernmental revolving funds to pay for activities (i.e., payroll) within or among federal agencies. Given the relative decline in resources for discretionary spending, careful management of agency budgets is vital to ensuring that agencies can continue to effectively achieve their missions and deliver services to the public. It is part of current outlays (spending) by the government and appears as an outlay in the budget. This is higher than the long term average of 20.60. Note: Net interest is primarily interest paid on debt held by the public. US Federal Government Spending is at 24.31, compared to 23.83 last quarter and 23.81 last year. The federal deficit in 2016 was 587 billion, equal to 3.2 percent of gross domestic product.

30, 2022, creating a 1.837 trillion deficit for Oct. The Federal Budget in 2016: An Infographic. As a result, mandatory spending has further increased compared to discretionary spending, continuing a trend that has been in place for several decades and is projected to continue. government estimates it will receive 4.174 trillion in revenue through Sept. Of the trillions of federal dollars spent on pandemic recovery, the majority has taken the form of mandatory spending. In FYs 20, the federal government responded in an unprecedented manner to address the COVID-19 pandemic and resulting severe economic repercussions. Supports agency programs and operations, such as most spending on defense, education, housing, and energy Supports programs such as Medicare, Social Security, and various veterans’ programs As a percentage of GDP, the decit increased from 2.4 percent in 2015 to 3.2 percent, the rst such increase since 2009. Informed by agency budget estimates and congressional priorities In 2016, the budget decit rose for the rst time in a number of years, totaling 587 billionabout one-third more than the 438 billion shortfall recorded in 2015. Generally driven by eligibility rules and benefit formulas This can take the form of mandatory or discretionary budget authority. If you have questions, requests, or need help locating a document, please contact us.Congress passes laws that authorize agencies to spend (“obligate”) federal dollars. On request, we can arrange for accessible formats and communication supports. We are committed to providing accessible customer service. Graphic The Federal Budget in Fiscal Year 2020: An Infographic ApThe federal deficit in 2020 was 3.1 trillion, equal to 14.9 percent of gross domestic product. Ontario Budgets for years prior to 2001 (Archives of Ontario) The Ontario Legislative Library has a collection of past editions of the Ontario Budget in PDF format. Find older editions of the Ontario Budget

0 kommentar(er)

0 kommentar(er)